- Two out of three solar panel users plan to integrate aerothermal energy to achieve full energy self-sufficiency

- Market uncertainty drives 71% of Spaniards towards stable tariffs, positioning self-consumption as the key to cost control

- Between 60% and 70% of households finance their installations; up to 80% if batteries are included or projects exceed €10,000; more than 10,000 financed installations in 2026

- Interest in Catalonia grew by 20.6% thanks to efficient management of local incentives

Madrid, 14 January 2026. After the strong growth of previous years, the self-consumption sector in Spain has entered a phase of maturity and consolidation. The “Solar Report 2025: A Snapshot of Self-Consumption in Spain” by SotySolar, developed in collaboration with UNEF, Huawei, Pontio, BayWa r.e., 8-33 and Clevergy, explores the motivations and behaviour of Spaniards regarding solar energy, revealing a profound shift in consumer priorities.

This change in mindset is clear and contrasts significantly with the conclusions of the Solar Report 2024. Just one year ago, only 22% of homeowners considered installing solar panels, discouraged by falling energy prices and the withdrawal of European aid. UNEF recorded a 31% slowdown in the installation rate in 2024 compared to 2023.

The Great Blackout changed the rules of the game

The turning point came with the Great Blackout of spring 2025, which left millions of households across the Iberian Peninsula without power. This event triggered a surge in searches for solar and home storage solutions, transforming public perception. As a result, self-consumption stopped being seen solely as a way to save money and became a guarantee of resilience and energy independence.

In this new context, according to data from the Solar Report 2025, although financial savings remain the main motivation for installing solar panels (65% in 2025 vs. 60% in 2024), factors such as sustainability (12%) and energy independence (8%) have gained relevance.

“Self-consumption in Spain has gone from being a costly, niche technology to becoming a common, reliable and essential household appliance. After the 2025 blackout, the market has evolved from a simple search for savings towards a model of total energy independence, where solar panels are integrated with batteries, electric vehicles and heat pumps to ensure a self-sufficient and sustainable home,” highlights José Donoso, CEO of UNEF.

Aerothermal energy: from largely unknown to a pillar of energy savings

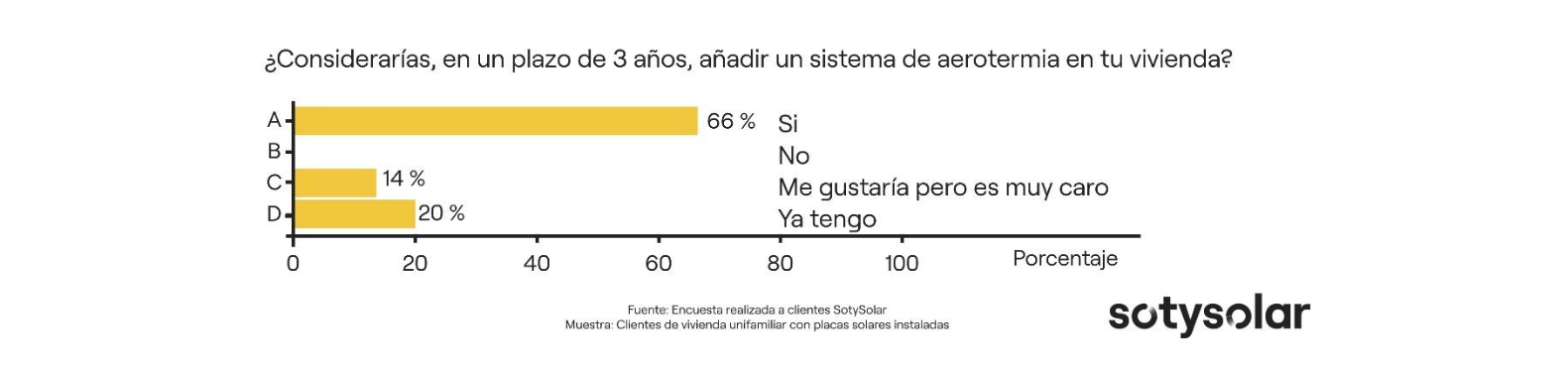

Aerothermal energy has undergone a radical transformation in just one year. While in 2024 half of homeowners considered its upfront cost excessive and awareness was low, in 2025 purchase intention has surged: 66% of those who already have solar panels plan to install aerothermal systems in their homes within the next three years.

Unlike solar energy, demand for aerothermal systems does not depend on cyclical factors such as prices or energy crises, but rather on climate seasonality and increased awareness of efficiency. Peaks in interest occur during periods of higher heating or cooling needs, yet average interest remains stable, reflecting growing market maturity.

Perceptions and experiences of a more informed and demanding consumer

Sector instability has led society to prioritise spending security over other variables, driving 71% of Spaniards to prefer stable energy tariffs and positioning self-consumption as a key tool for cost control.

When choosing an installer, price remains important (45%), but trust-related factors such as customer recommendations (25%) and support with paperwork and subsidies (20%) are gaining ground. This preference for professional guidance and process clarity reflects growing demand for comprehensive and reliable services.

Financing: from barrier to industry driver

The financing model has undergone a radical shift. While in 2024, 73% of homeowners were unaware of available subsidies and cautious about the initial investment, in 2025 between 60% and 70% of households opt for flexible payment solutions—a figure that rises to 80% for projects exceeding €10,000 or including batteries.

This progress is driven by the consolidation of financial solutions that eliminate upfront costs and offer 100% digital processes, allowing users to start paying instalments only once the system is fully operational. Partners such as Pontio project more than 10,000 financed installations in 2026, highlighting how payment flexibility is breaking down barriers and making this technology accessible.

The new role of subsidies and the maturity of self-consumption in 2025

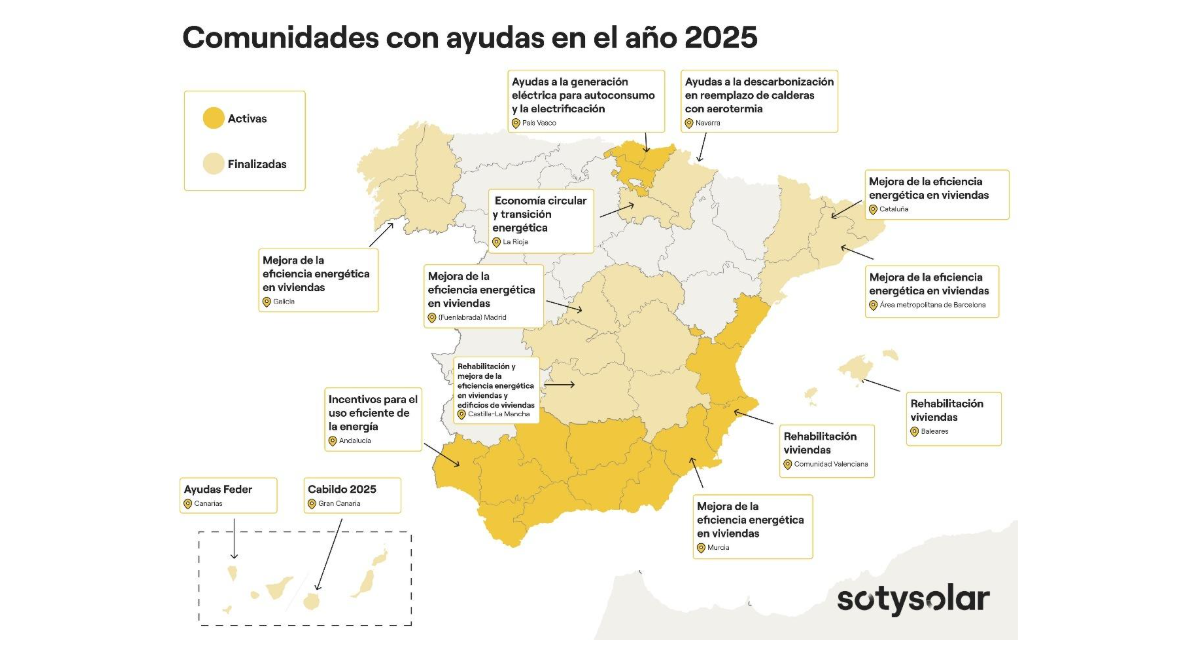

Following the closure of the European Next Generation funds, the market has evolved from reliance on direct subsidies towards a more structurally profitable model. Analysis by autonomous community shows that the impact of these programmes varies significantly by region.

In this regard, Catalonia stands out as a benchmark of success. Subsidies in the region acted as a strong market catalyst, attracting consumers with a mature intention to execute their projects. The result was a 20.6% increase in interest. Similar patterns, with regional nuances, can be observed elsewhere: from decarbonisation aid to replace boilers with aerothermal systems in Navarre, to incentives for efficient energy use in Andalusia, and energy improvement programmes in Murcia, Galicia and the Basque Country.

In this regard, Catalonia stands out as a benchmark of success. Subsidies in the region acted as a strong market catalyst, attracting consumers with a mature intention to execute their projects. The result was a 20.6% increase in interest. Similar patterns, with regional nuances, can be observed elsewhere: from decarbonisation aid to replace boilers with aerothermal systems in Navarre, to incentives for efficient energy use in Andalusia, and energy improvement programmes in Murcia, Galicia and the Basque Country.

The clearest positive impact occurs when incentives are implemented in markets with a high level of awareness and a well-defined purchase intention, acting as the final push for project execution. Administrative simplicity and timely delivery of aid are also key. Tax incentives have a direct impact on consumers’ wallets, far more than the limited financial compensation for surplus energy fed into the grid, which is perceived as intangible and unconvincing.

“The Solar Report 2025 confirms that self-consumption in Spain has matured: it is no longer a short-term response to electricity prices, but a strategic decision by citizens seeking control, security and sustainability. The spring blackout was a turning point that accelerated demand for energy resilience. At SotySolar, we have reached break-even in Spain and Portugal because we understand that our job is not only to sell and install solar panels, but to accompany the customer throughout the entire process. In fact, 20% of our clients choose us precisely for that comprehensive support, reinforcing our belief that the future of the sector is built on trust, professionalism and a long-term vision,” says José Carlos Díaz Lacaci, CEO of SotySolar.

“The path towards demand electrification is irreversible, and Spain has all the conditions to lead it: abundant sunshine, mature technology, accessible financing and, above all, an increasingly aware and committed society. Our challenge is to grow well—solidly, profitably and always with the customer at the centre,” concludes the CEO.

• Stock photos and videos and spokesperson materials

• Charts included in this press release in JPG format

• Full report (for media consultation only when preparing content; distribution or publication in its entirety is not permitted)